Payment System Risk Charter

Achieve project success with the Payment System Risk Charter today!

What is Payment System Risk Charter?

The Payment System Risk Charter is a comprehensive framework designed to identify, assess, and mitigate risks associated with payment systems. In the modern financial ecosystem, payment systems are the backbone of economic transactions, facilitating everything from small-scale purchases to large-scale corporate transfers. However, these systems are vulnerable to a variety of risks, including fraud, operational failures, and cybersecurity threats. The Payment System Risk Charter provides a structured approach to address these vulnerabilities, ensuring the integrity, security, and efficiency of payment operations. For instance, in a scenario where a financial institution is launching a new digital wallet, the charter can guide the team in identifying potential risks such as unauthorized access or data breaches, and implementing controls to mitigate them.

Try this template now

Who is this Payment System Risk Charter Template for?

This Payment System Risk Charter template is ideal for financial institutions, payment processors, and fintech companies. It is particularly useful for risk managers, compliance officers, and IT security teams who are responsible for safeguarding payment systems. For example, a compliance officer at a bank can use this template to ensure that all regulatory requirements are met while minimizing operational risks. Similarly, a fintech startup launching a new payment app can leverage the charter to identify potential vulnerabilities and establish robust security measures. The template is also valuable for project managers overseeing payment system upgrades or integrations, providing them with a clear roadmap to address risk-related challenges.

Try this template now

Why use this Payment System Risk Charter?

The Payment System Risk Charter addresses specific pain points in the payment ecosystem, such as fraud detection, regulatory compliance, and operational resilience. For instance, one of the major challenges in cross-border payments is the risk of money laundering. This charter provides a detailed framework for implementing anti-money laundering (AML) controls, ensuring compliance with international regulations. Another common issue is the risk of system downtime, which can disrupt transactions and erode customer trust. By following the charter, organizations can implement redundancy measures and real-time monitoring to minimize downtime. Additionally, the charter helps in addressing cybersecurity threats by outlining best practices for data encryption, access control, and incident response. By using this template, organizations can proactively manage risks, protect their reputation, and ensure seamless payment operations.

Try this template now

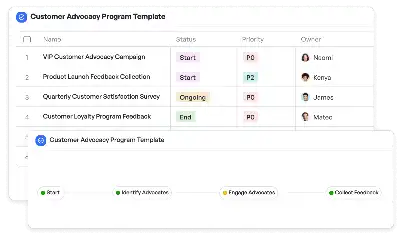

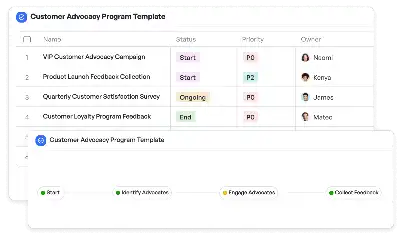

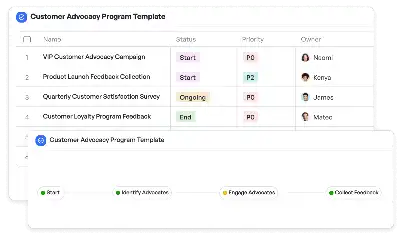

Get Started with the Payment System Risk Charter

Follow these simple steps to get started with Meegle templates:

1. Click 'Get this Free Template Now' to sign up for Meegle.

2. After signing up, you will be redirected to the Payment System Risk Charter. Click 'Use this Template' to create a version of this template in your workspace.

3. Customize the workflow and fields of the template to suit your specific needs.

4. Start using the template and experience the full potential of Meegle!

Try this template now

Free forever for teams up to 20!

The world’s #1 visualized project management tool

Powered by the next gen visual workflow engine