How to Implement Lean in Finance

In today’s fast-paced business environment, finance teams face increasing pressure to deliver accurate, timely insights while controlling costs and improving operational efficiency. Applying lean principles in finance—commonly called “Lean Finance”—has become a proven approach to help finance departments eliminate waste, streamline processes, and create more value with fewer resources.

In this article, we’ll explore what lean means in finance, how lean methodologies can transform finance operations, common challenges in adopting lean finance, and practical steps finance teams can take to start their lean journey. Along the way, you’ll also see how using the right templates can simplify process improvements and enable continuous monitoring of your lean initiatives.

What is Lean in Finance?

Lean originated as a manufacturing philosophy aimed at reducing waste and maximizing value, popularized by the Toyota Production System. Over time, it has expanded into various business functions, including finance.

Lean in finance means applying the core lean principles—eliminating waste, optimizing workflows, improving quality, and focusing on customer value—to financial processes such as budgeting, reporting, forecasting, accounts payable, and more.

The goal of lean finance is to make finance operations more efficient and agile by reducing unnecessary steps, automating routine tasks, and improving accuracy and responsiveness. This frees up finance professionals to focus on strategic activities that drive business growth.

Why Lean in Finance Matters for Software Companies

Software companies often operate in fast-changing markets with complex revenue models, subscription billing, and recurring customer contracts. Lean finance offers several benefits specific to this environment:

- Faster Reporting and Forecasting: Lean processes reduce bottlenecks and manual work, helping finance teams close books and generate forecasts more quickly.

- Improved Accuracy and Compliance: Standardized workflows and automation reduce errors and support regulatory compliance, which is critical for software companies dealing with global tax and revenue recognition rules.

- Better Resource Allocation: Eliminating waste frees up finance resources to focus on analysis, growth planning, and strategic initiatives.

- Scalability: Lean finance builds a foundation that scales smoothly as the company grows, avoiding chaotic or overly manual processes.

By adopting lean principles, finance teams can become more proactive partners to business leaders, providing timely insights that enable smarter decision-making.

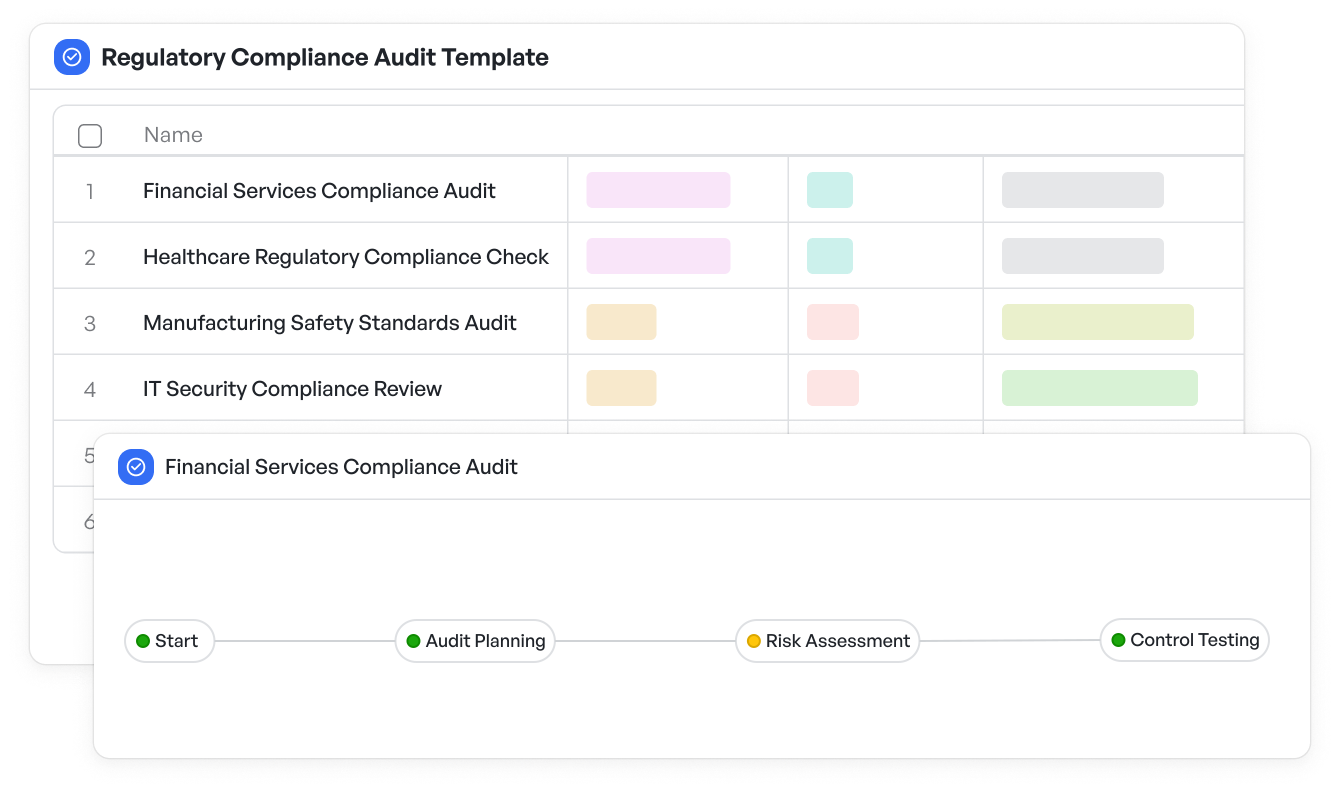

Regulatory Compliance Audit Template from Meegle.

Regulatory Compliance Audit Template from Meegle.You may be interested in: 👉Regulatory Compliance Audit Template

Key Principles of Lean in Finance

- Identify and Eliminate Waste Waste in finance includes redundant data entry, waiting for approvals, duplicate reconciliations, unnecessary reports, and rework caused by errors. The first step is mapping out existing workflows and identifying non-value-added steps.

- Optimize End-to-End Processes Lean focuses on improving whole processes rather than isolated tasks. This means looking at how activities connect and flow from start to finish, aiming for smooth handoffs and minimal delays.

- Empower Teams to Solve Problems Lean encourages a culture of continuous improvement, where finance professionals at all levels identify inefficiencies and contribute solutions.

- Use Data to Drive Decisions Lean finance relies on measurable outcomes and KPIs to track progress and spot issues early.

- Standardize Work Creating standardized processes and checklists ensures consistency, reduces errors, and makes training easier.

- Leverage Technology Automation and financial software play a crucial role in supporting lean workflows by reducing manual effort.

Read more: 👉The 5 Principles of Lean Project Management

Common Challenges in Implementing Lean in Finance

While the benefits are clear, many finance teams face obstacles in adopting lean principles:

- Resistance to Change: Finance teams often rely on traditional processes. Moving to lean requires a shift in mindset and habits.

- Lack of Visibility: Without clear process maps and data, it’s hard to identify waste or measure improvement.

- Siloed Departments: Lean thrives on cross-functional collaboration, which can be difficult if finance operates in isolation.

- Inadequate Tools: Lean finance requires tools for process mapping, automation, and performance tracking, which might not be in place.

- Balancing Speed and Accuracy: Accelerating processes without sacrificing quality is a delicate balance.

Understanding these challenges upfront helps set realistic expectations and encourages thoughtful planning.

Practical Steps to Start Lean in Your Finance Team

1. Map Your Financial Processes Begin by documenting current workflows end to end—such as month-end close, budget approval, or expense reporting. Use visual tools like flowcharts or swimlanes to spot bottlenecks and duplicated steps.

2. Identify Waste and Prioritize Improvements Classify process steps into value-added or waste. Focus first on quick wins that can save time or reduce errors with minimal effort.

3. Standardize and Document Best Practices Develop templates, checklists, and guidelines for consistent execution. This reduces reliance on tribal knowledge and improves onboarding.

4. Automate Routine Tasks Implement tools to automate data entry, approvals, reconciliations, and reporting wherever possible. This reduces manual errors and frees up staff time.

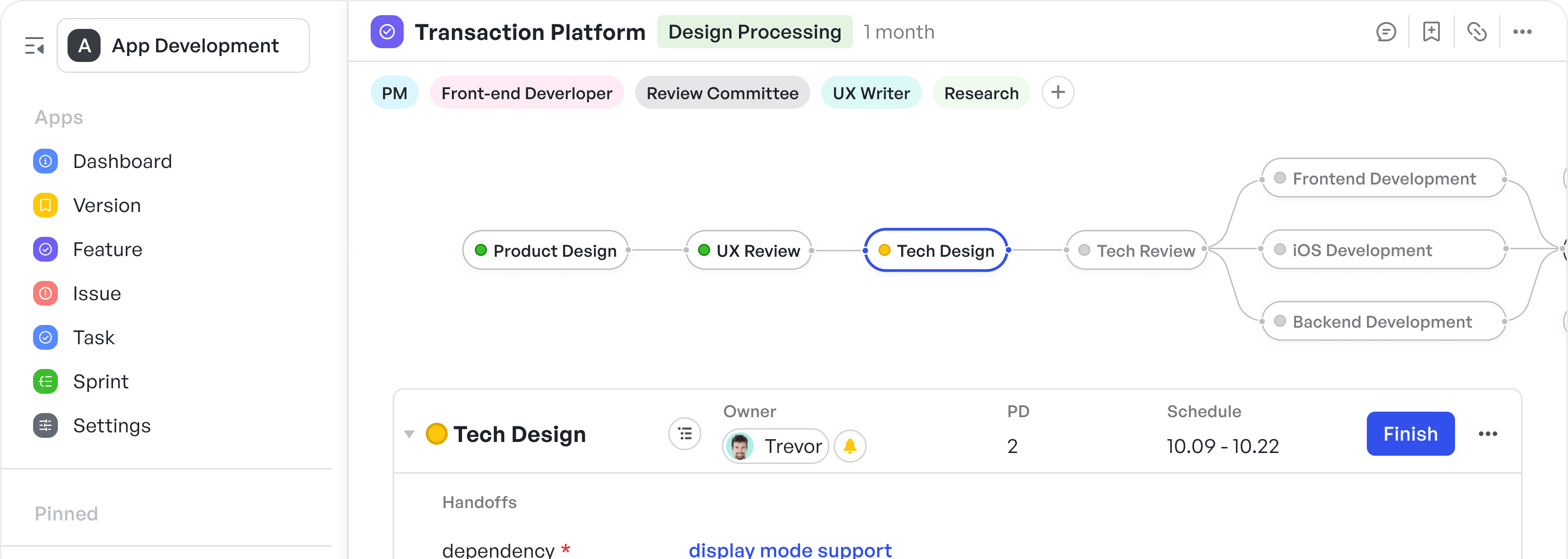

Check out Meegle’s free lead to cash template

Check out Meegle’s free lead to cash template5. Train and Involve Your Team Engage finance staff in identifying pain points and improvement ideas. Provide training on lean principles and tools.

6. Measure and Monitor Progress Define KPIs like cycle times, error rates, or number of manual touches. Use dashboards to monitor improvements and quickly address regressions.

7. Continuously Improve Lean is a journey, not a one-time project. Schedule regular reviews and promote a culture of ongoing problem-solving.

How Templates Can Simplify Lean in Finance Adoption

Using the right templates can be a game-changer when starting or scaling lean finance initiatives. Templates help standardize work, minimize errors, and ensure all team members follow the same process steps. They can also speed up process documentation and reporting.

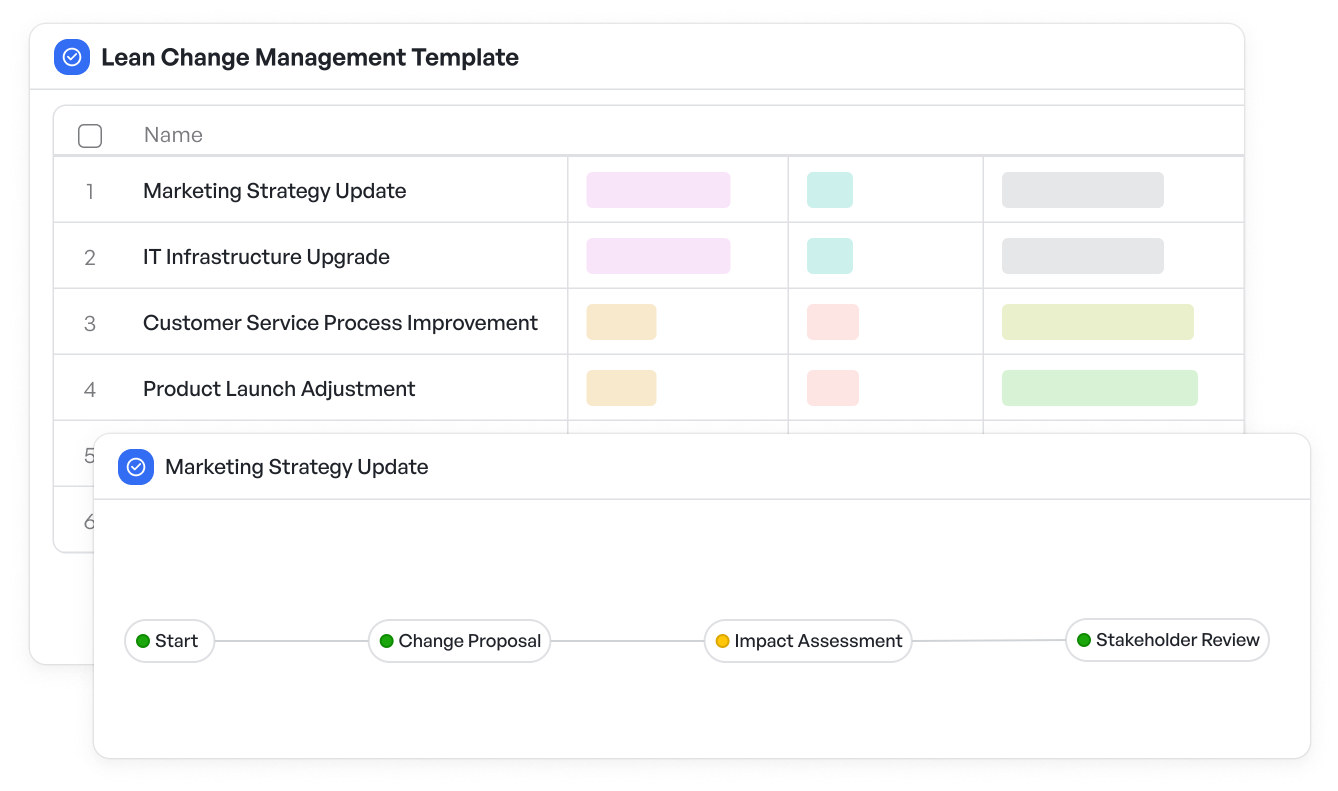

Achieve project success with the free Lean Change Management Template today.

Lean change management template

Lean change management templateFor example, templates for:

- Process Mapping: Standard flowchart templates make it easy to document and analyze workflows.

- Monthly Close Checklists: Ensure all steps are completed on time without omissions.

- Budget Review Worksheets: Streamline approvals and track version history.

- Expense Report Forms: Standardize data capture and reduce manual validation.

Meegle offers a variety of customizable templates designed specifically for finance teams aiming to implement lean principles. These templates reduce the upfront effort required to standardize processes and create clear documentation—critical first steps in lean transformation.

Realizing Value: Benefits of Lean Finance

Drive Efficiency and Agility in Your Finance Operations

Lean in finance is more than just cutting costs—it’s about building a finance function that is responsive, accurate, and aligned with business needs. By eliminating waste and standardizing processes, finance teams can close books faster, reduce errors, and provide better insights to leadership.

This efficiency translates into agility. SaaS businesses can rapidly adapt financial plans and forecasts as markets shift, confidently scaling operations without disruption.

Leveraging templates and tools designed for lean finance accelerates this transformation, enabling your team to focus on strategic priorities instead of firefighting operational issues.

Unlock Financial Excellence with Lean in Finance

Adopting lean principles in finance empowers your team to work smarter, not harder. It reduces manual effort, improves accuracy, and delivers faster insights that fuel better business decisions. With the right approach, culture, and tools—including well-designed templates—you can build a finance function that scales with your business and drives sustainable growth.

Ready to simplify your lean in finance journey?

Reimagine finance with Meegle — cut the waste, keep what drives growth. Start now.

The world’s #1 visualized project management tool

Powered by the next gen visual workflow engineRead More

Check All BlogsStart creating impactful work today